Associations

As part of the wealth management process, after reviewing your investment needs and objectives, Aaron may refer you to other professionals for additional services including access to registered portfolio managers. Worldsource has a referral arrangement with Guardian Capital Advisors LP

Aaron Fransen, CFP®, CHS, MFA™

Certified Financial Planner® Professional

The Value of Advice

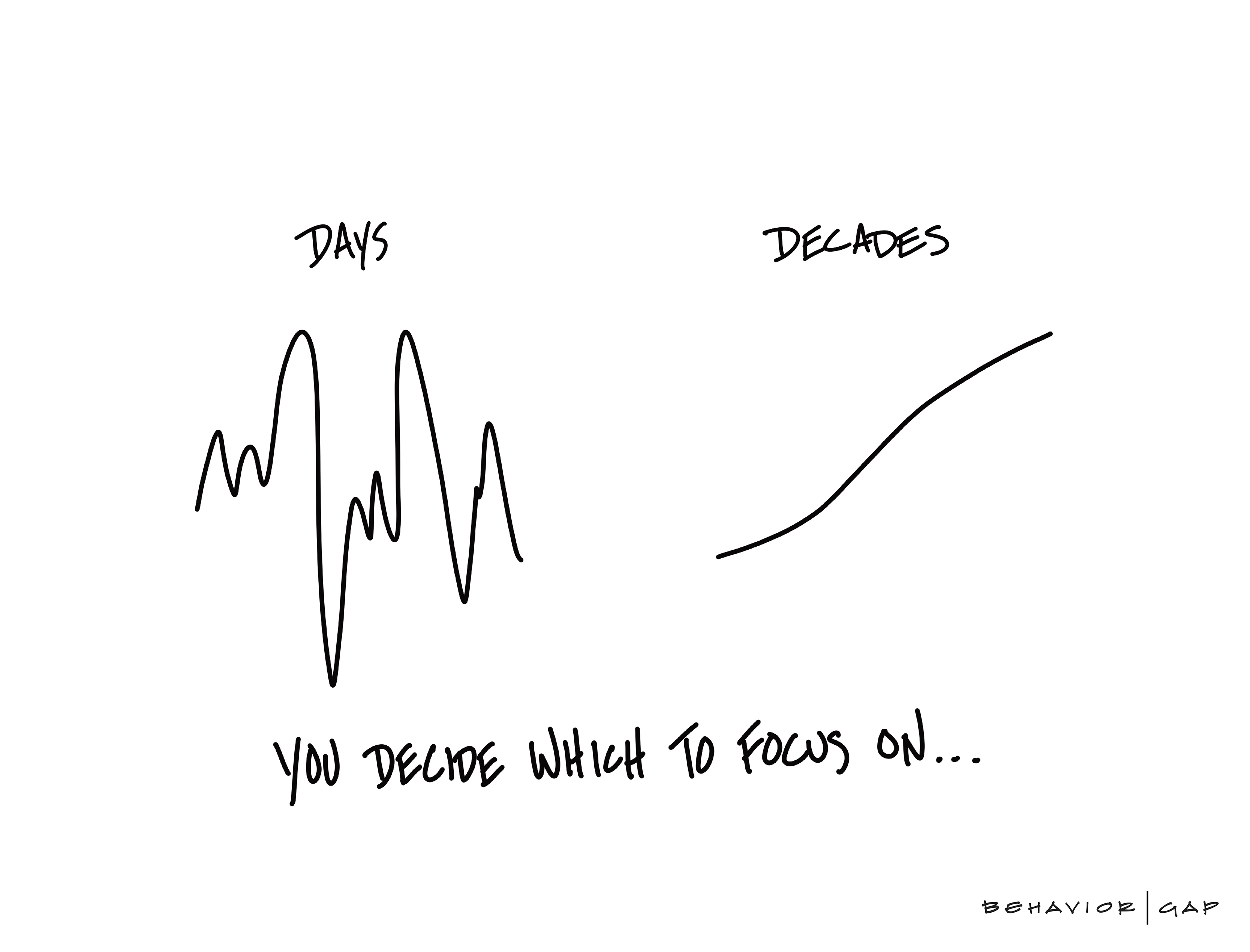

Many Canadians believe they do not have enough assets to seek the advice of an advisor. This is far from the truth at Fransen Financial. Numerous studies have validated the fact that professional advice works for investors of all circumstances. To secure a healthy financial future for yourself and your family at all stages of life, it’s important to address a number of major issues that will ultimately help reduce financial stress, plan appropriately for your situation and, most importantly, grow your net worth. Aaron is here to help you navigate these challenges and help you stay on track.

Aaron’s whole wealth approach to retirement income planning will answer what is on most Canadian’s minds when it comes to retirement income planning and portfolio management:

- “When will I be able to retire?”

- “How much can I spend?”

- “How much do I have to save?”

- “What rate of return do I need to earn?”

Since May 2018, Worldsource Financial Management has been a valued partner of Aaron and Fransen Financial. Worldsource Financial Management works with advisors like Aaron who have built their clientele on a strong foundation of one-on-one relationships and the highest level of trust.

Tel: 604-531-0022

Email: info@fransenfinancial.com

South Surrey, BC

Education

Frequently Asked Questions

Do you have corporate budgets and sale quotas?

No. We do not have budgets or quotas like some banks or dealers in Canada. We have no external pressure from our mutual fund dealer which is why we chose to partner with WFM.

Are you independent?

Yes, fiercely. We are free to shop the market and partner with mutual fund and ETF manufacturers that we feel are best suited for our clients. We are not distributors for the manufacturer or told we must offer certain products to satisfy corporate agendas.

Are you paid up-front commissions for investments?

No. We are not compensated based on transactions or up-front commissions. We offer our clients two methods of compensation; an embedded service fee model and/ or a fee-based model.

Do you offer a high net worth platform?

Yes. We have partnered with a number of private wealth management firms that we feel and are best suited for clients who have amassed $1,000,000 + of investable assets. So as part of my wealth management process, after reviewing your investment needs and objectives, I may refer you to these professionals as part of a referral arrangement.

Worldsource Financial Management

Worldsource Financial Management supports the innovative and entrepreneurial approach that independent advisors bring to their professional practice – helping them deliver a greater level of services to their valued clients. Today, mutual fund advisors from across the country have partnered with us to better their businesses and relationships with investors, like you.

Mutual Funds and some Segregated Funds provided by the Fund Companies are offered through Worldsource Financial Management Inc., sponsoring mutual fund dealer. Other Products and Services are offered through Fransen Financial Inc.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the simplified prospectus and/or fund fact sheet before investing. Mutual funds are not guaranteed and are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Fund values change frequently and past performance may not be repeated. Worldsource Financial Management Inc. (WFM) is responsible only for mutual fund-related business activities conducted by its Registrants and is not responsible for any other business interests and activities undertaken by its Registrants or by Fransen Financial Inc. All information provided here is believed to be accurate and reliable, however, we cannot guarantee its accuracy and WFM will not be held liable for any inaccuracies in the information presented, nor will WFM be held liable for any software damages resulting from the use of this website. Mutual funds are offered in Canada only. This Internet Website does not constitute an offer or solicitation in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it is unlawful to make such offer or solicitation. Worldsource website www.worldsourcefinancial.com.