Retirement

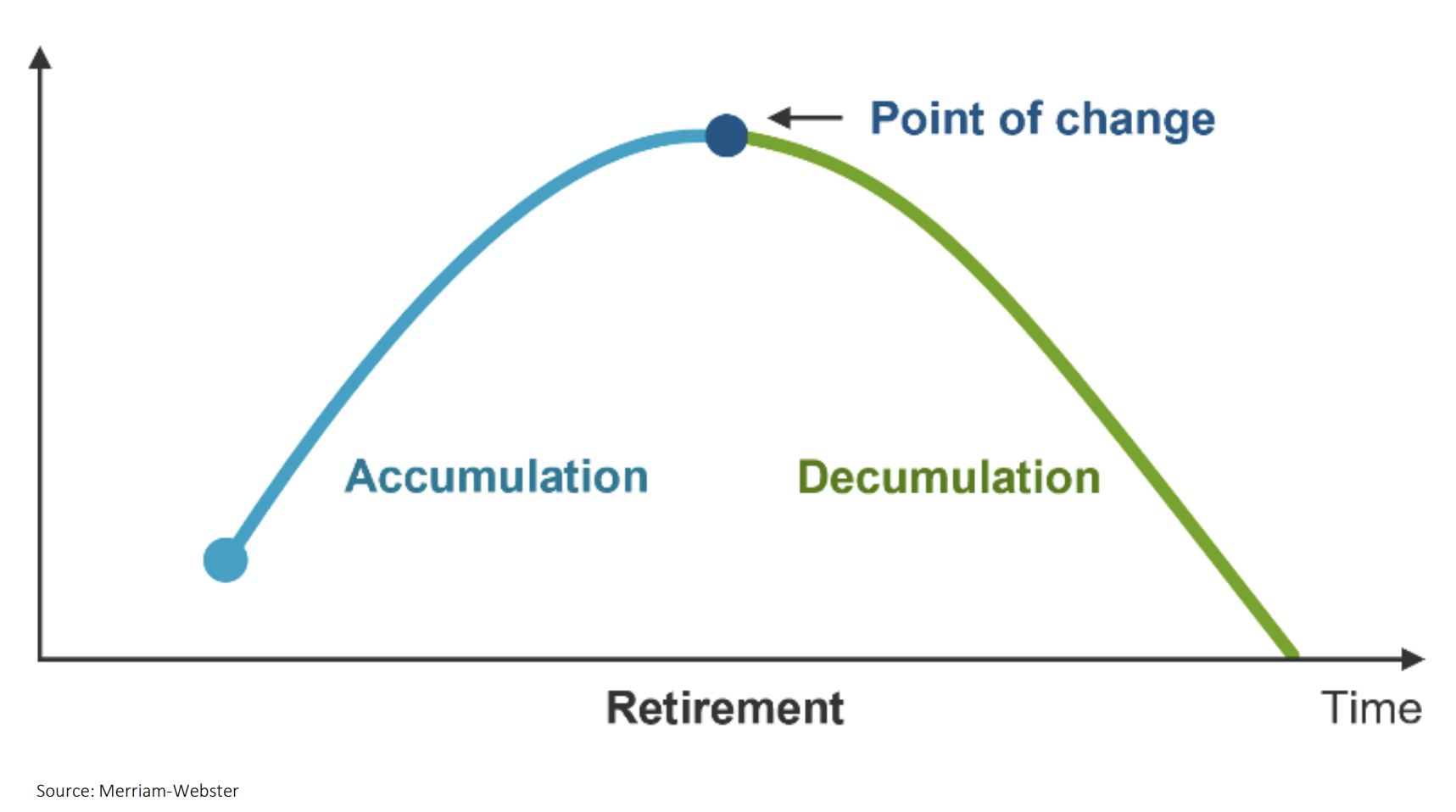

Many of us dream of the day that we can retire and have the time to ourselves that we have dreamed of for many years. But, in order to have a truly comfortable and enjoyable retirement, you need to ensure that you have the means to afford it. When putting together a retirement plan, it’s crucial to consider the two key stages of retirement.

Accumulation

For most clients, retirement planning is about saving money in RRSPs, TFSAs, and other investments for a comfortable retirement. Initially, the focus is on strategies like asset allocation, risk management, and tax efficiency to enhance returns. However, as retirement nears, the emphasis must shift from saving to spending.

Decumulation

Decumulation planning, the strategic spending of assets for retirement goals, is more intricate than accumulation planning. It involves guiding clients on how much to spend, the order of asset utilization, and when to apply for CPP and OAS benefits. A misstep here could cost clients significantly in lost wealth over their lifetime.

The R4R Financial Assessment ™

The R4R Financial Assessment™ will produce The Retirement Options chart that analyzes the 4 Primary Planning Options that are available to you. These 4 options are the basic changes, or next best actions, needed to eliminate future cash flow excesses or deficiencies. Combined, they will provide answers to the most common questions Canadians have about their retirement:

- Are my goals realistic based on my current income?

- Where should I be invested based on the goals I have?

- How much of my income do I need to contribute to my goals?

- What is the one thing I should focus on accomplishing first?