Financial Planning

The top 6 financial planning questions that we typically hear:

- How long will my money last so that I will be OK?

- How much can I spend so I won’t run out of money?

- When should I take my government benefits (CPP/QPP and OAS)?

- Which of my assets should I spend first?

- I’m currently saving $X – is this going to be enough?

- How much can I pass on to my children when I die?

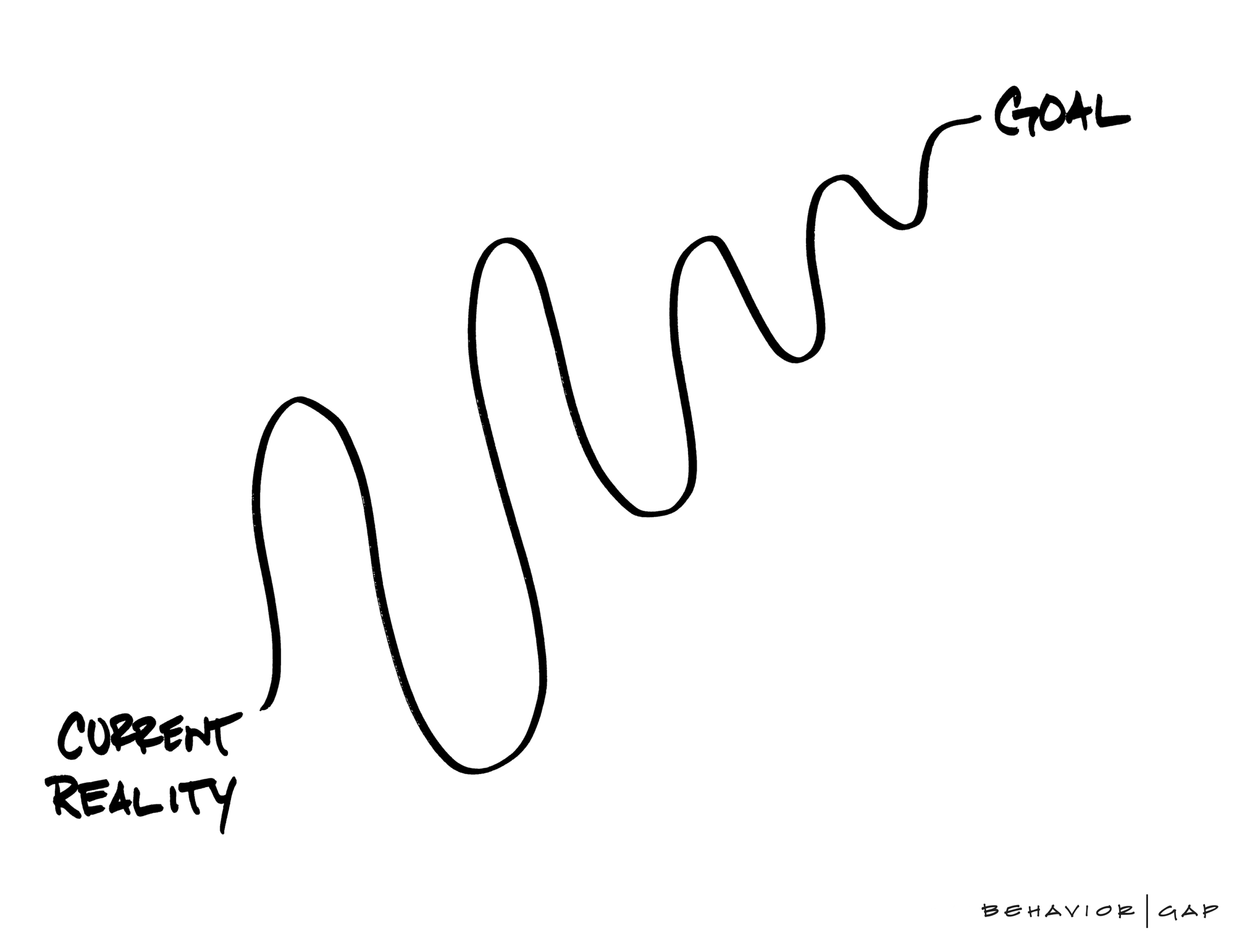

A financial plan looks at where you are today and where you want to go. It determines your short, medium and long term financial goals and how you can reach them.

Why do you need a Financial Plan?

- Worry less about money and gain control.

- Organize your finances.

- Prioritize your goals.

- Focus on the big picture.

- Save money to reach your goals.

What does a Financial Plan include?

There are 2 main sides your financial plan should address: Accumulation and Protection

Accumulation:

- Cash Management – Savings and Debt

- Tax Planning

- Investments

Protection:

- Insurance Planning

- Health Insurance

- Estate Planning

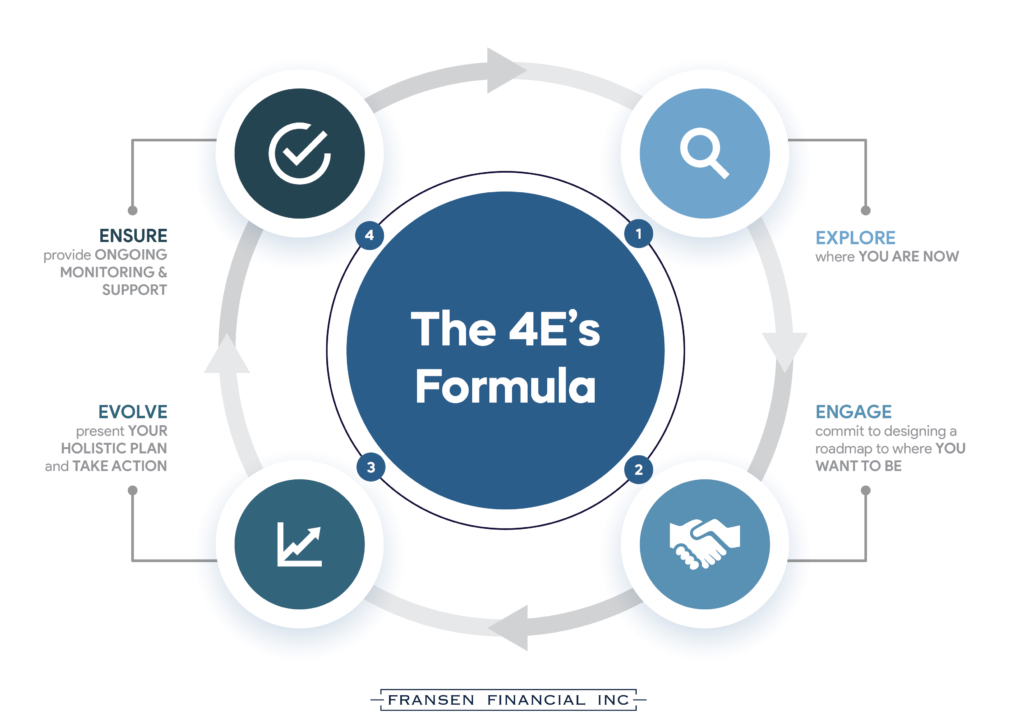

Next steps…

- Talk to us about helping you get your finances in order so you can achieve your lifestyle and financial goals.

- Feel confident in knowing you have a plan to get to your goals.